How to Use the CBA Phenomenon to Boost Your Gains

I wish I had a count on the number of people who probably gave up gambling–

Sorry, “trading” forever in the last few months.

Since the stock market began to correct in January, I keep seeing absolutely astounding stories of losses.

One common thread I see, among these stories, is people who “bought the dip,” expecting the market or some meme stock to quickly rebound.

What that usually means is…

They saw the stock tumble 30%...

They went all in, or bought risky call options on the stock…

Then the stock tumbled more…

Then they sold to limit their losses, or saw their call option bet expire completely worthless.

Now, I think you and I need to have a little talk about what “buying the dip” actually means, and how you can use it to make money instead of, you know, donating it to Wall Street.

What’s the Point of Buying the Dip?

The secret sauce of any good dip-buying strategy is the “CBA Phenomenon”...

A fundamental and universal mathematical principle you can always use to your advantage when it comes to investing.

It works like this…

Say you have two investors.

Their names are Lucretia Bottombuyer and Gambly McBadinvestor.

They both have $20,000 cash in their investment portfolios.

Say they want to buy a stock. Let’s call this stock Amagoogflix.

Amagoogflix is trading at $100 per share.

Lucretia and Gambly both like the made up company “Amagoogflix.”

They both have confidence in the company, and use the company’s widget//streaming/gaming/platform/ecommerce/crypto/blockchain/anime waifu service on a daily basis.

Lucretia buys 10 shares and it costs (10*100=) $1000. The stock is now 5% of her portfolio.

Gambly buys 100 call options, betting that Amagoogflix will hit $150 by January of next year. Each option contract costs $70, so he has bet (100*70=) $7000.

But then: oh no! Calamity strikes!

Terrorists attack the Panama Canal!

China invades Taiwan and the U.S. says, “Well good luck with that!”

Jerome Powell mainlined PCP, tore off his clothes, and decided to hike interest rates by 6%!

For whatever silly, ludicrous reason, the whole market tanks.

Over the course of about 45 days, the S&P drops by -10%. The Nasdaq drops by -20%. The Russell 2000 drops by -30%.

(You know… what investors in 2022 just experienced.)

Most stocks are largely correlated with the market. So when investors sell the market, these stocks get sold off, too.

That includes Amagoogflix, which drops 20% as well. It’s now trading at $80.

Gambly McBadinvestor panics. Because they’re leveraged and affected by volatility, his call options are down -50%. His bet is now worth $3500.

He sells to stop the bleeding. No diamond hands on this fellow.

But Lucretia looks at Amagoogflix. She suspects that this company is still going to make money and keep growing regardless of whatever is happening in the world.

She decides to buy the dip. She puts in another $1000.

Amagoogflix is $80, so this gets her another (1000/80=) 12 shares, rounded down.

Now, this is where the CBA math magic comes in.

She now owns 22 shares of Amagoogflix, but has only invested $1,960.

That means Lucretia owns Amagoogflix at (1960/22=) $89 per share.

That is, her Costs Basis has been Averaged down. CBA, baby.

(If I started this whole exercise by talking about the merits of “cost-basis averaging,” I guarantee 90% of you would have zonked out. A spoonful of sugar helps the medicine go down.)

And then: Hooray! A market rally!

China acknowledges Taiwan’s independence!

Inflation magically reverts back to 2%!

Whatever happens, the market begins to climb again.

Now the S&P is down only -4% from its highs.

The investment market realizes it was really dumb to dump Amagoogflix and it goes rip-roaring back up to $95.

Gambly positively KICKS himself for ever having doubts about Amagoogflix going to the moon.

He buys 100 call options again, betting again that Amagoogflix will hit $150 by January of next year.

But now that there’s upside volatility, call options are more expensive.

Each option contract costs $100, so he has bet (100*100=) $10,000.

Meanwhile, Lucretia barely looks at her portfolio. Because she bought the dip, her investment is actually up 6.7%.

She’s styling. Cool as a cucumber.

But: oh no again! That market rally was a “bull trap”!

The dip dips into a dippier dip!

Markets are down -40% from their highs!

Jim Cramer looks like a frazzled ghoul on television as he performs his schtick!

Anyway, Amagoogflix drops down to $60. -40% from its highs. Ouch.

Lucretia doesn't care. Recession or not, she knows people are going to use Amagoogflix’s services for years in the future, and not many companies even come close to matching the amount of money they make every year.

She invests another $1,000 worth. She adds 16 more shares.

That means Lucretia Bottombuyer now owns 38 shares of Amagoogflix at a cost basis of (((10*100)+(12*80)+(16*60))/38=) $76.84 per share.

She has now invested about $3,000, or 15% of her $20,000 portfolio.

Gambly has learned from his mistake. He’s not going to sell the dip. He’s going to buy the dip!

Gambly is the type of person who often feels and acts like the smartest person in the room. Even though he’s not.

His $150 Amagoogflix call options are now trading at $50 per contract.

If you’ve been watching the scoreboard, Gambly lost $3,500 the first time around. And now his $10,000 bet on 100 contracts is worth $5,000.

“YOLO,” he says with cavalier self-assurance before snapping into a Slim-Jim.

He also knows that Amagoogflix is a great company, sure to go to the moon.

He bets his remaining $6,500 in cash on 130 more call option contracts at the same $150 strike price and the same expiration date.

“This can’t possibly go tits up,” he says. And then goes to have a nap.

Gambly now owns 230 call options for Amagoogflix. He has also benefited from CBA, and his average cost is $71.73 per contract.

TIME PASSES

People forget whatever was scaring them a few months ago.

It is now January in the year following the beginning of Lucretia and Gambly’s stock market adventure…

And as is the case about half the time, the stock market recovers within the same year it experienced the dip and the dippier dip I described above.

Amagoogflix grows to $110.

Because of the simple magic behind CBA, Lucretia’s investment has grown by 43%. The ~$2,900 she invested is now worth $4,180.

Good for her. She has done good at investing.

She can let it ride for the rest of her life. Or she can sell $3,000 worth of shares (about 28).

That would mean she’s back to owning just 10 shares of Amagoogflix like she did at the start…

Her cost basis, though, is less than $0.

Meaning she now has over $20,000 in cash AND 10 free shares of the stock she wanted to own forever to begin with.

It’s all because of the magic of CBA – the same magic that’s helping me profit from following the Finance Daddy $10 Daily Challenge.

But poor Gambly…

You might notice, dear reader, that $110 is less than $150.

And we are now past the expiration date for his enormous call option bet.

That means they expire completely worthless. Gambly’s $20,000 has gone to $0.

Gambly sighs and begins looking to see if his local Wendy’s is hiring.

And thus the tale of these two investors has reached its conclusion…

Until the next insane, irrational bull market, when the next generation of stupidity abounds once more (I’m looking at you, NFTs!).

So What Have We Learned?

First thing’s first, “buying the dip” is not a short-term play.

If you’re looking at getting rich in a few weeks… You’re going to have a bad day when you realize that your big dip buying bet keeps going down longer than 5 months (the average length of a drawdown).

If you read my recent example about Legacy investing, you should know that dips can actually last years.

That means, second thing, you want to buy the dip when the company is actually, like, good.

And I don’t mean “good” as in “doesn’t pollute the environment” or “treats its employees well” or “hasn’t been involved in poisoning infants to death.”

Nestlé has failed at all three of the above. But I’d still buy its stock if its valuation looked attractive.

I mean good in the only sense that a company can be good: It consistently produces profits for its shareholders, and looks likely to keep doing so for decades in the future.

That’s it. That’s what a business exists for.

Investments aren’t charity. You aren’t helping cure breast cancer when you buy a share of AstraZeneca.

Your investment dollars (usually) don’t even end up in the hands of the company you’re investing in – just whatever market maker or bank owned the shares before you.

The only reason to invest is to make money.

And third thing, selloffs can happen to any stock for any reason. Including good ones.

None of this “rational market” or “everything is priced in” nonsense.

Stocks only go down in value for one reason: People selling them.

And people sell stocks for all sorts of reasons, including stupid ones.

So the easiest way to make money in the markets, then, is to wait for an irrational selloff of a good and growing company…

And then buy it.

I’ll give you a real life example of everything I’m talking about…

But instead of Amagoogflix, let’s use the real Amazon.

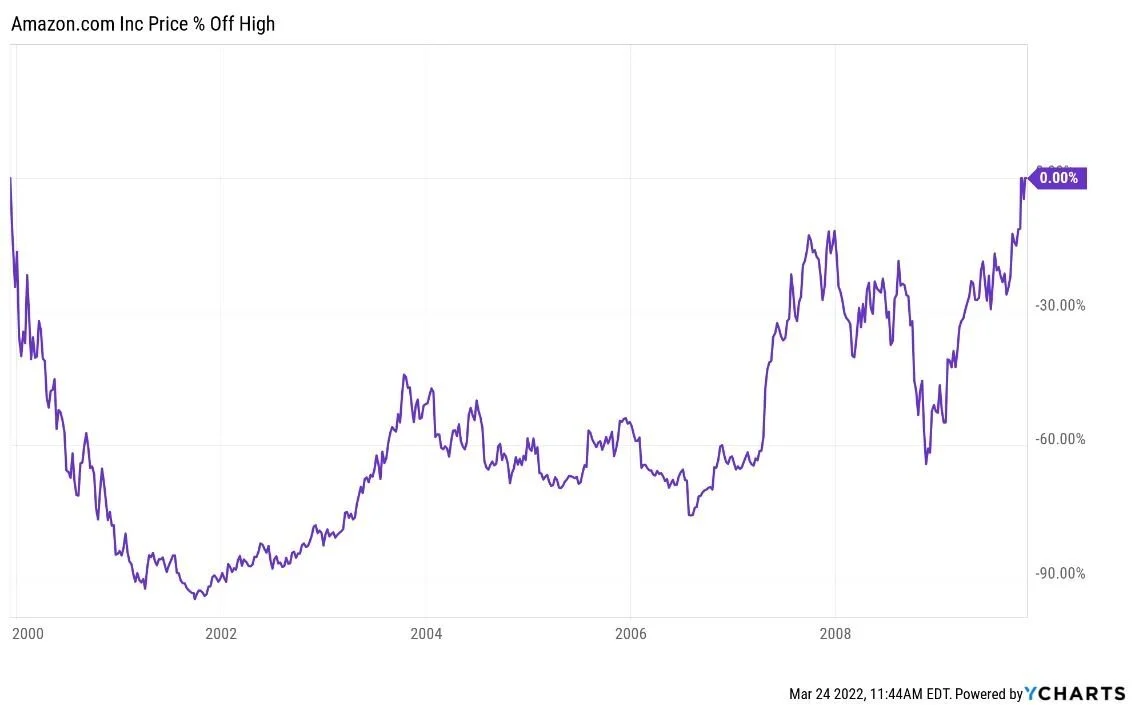

Amazon is actually one of the most famous “crash” stories in the history of growth stocks.

Everyone on the planet knows this company now…

But back in the year 2000?

It was an unprofitable online bookstore in a high inflation (3.36%), high interest rate (6.24%) market.

All things considered: The outlook for growth stocks was much worse than it is now.

Yet Amazon had all the makings of an ideal stock in the burgeoning ecommerce market.

So I want you to imagine that I sent you a recommendation for Amazon stock on December 13, 1999…

The day Amazon reached its peak before the dot-com crash.

Say you invested $10,000 when Amazon was $102 per share. If you are just looking at price alone, it would have taken you 9 years to break even on Amazon stock…

And it would have been worth it to wait, because your investment in about 97 shares would have risen to over $307,000 (a nearly 3,000% increase) by March 22, 2022—even with the recent pullback.

But in the two years following your initial investment, you would have had to hold through a 93% drop in your initial investment.

Not many people can do that. They would have panicked and sold. So let me paint you a different scenario…

Let’s say, hypothetically, I issued you a buy recommendation for Amazon on December 13, 1999…

Let’s say that I advised you to buy Amazon in five equally sized installments, called “tranches.”

These new tranches should be purchased every time the share price dropped by 20% over the course of a month.

Not within a month… just checking the price on the 13th of each month.

And if you ever saw a 100% gain? Your instructions were to sell half your shares.

So let's see what happened.

If you had $10,000 to invest… that means you would have bought

About $2000 worth or 19 shares on December 13, 1999

About $2000 worth or 30 more shares on January 13, 2000

About $2000 worth or 40 more shares on April 13, 2000

About $2000 worth or 57 more shares on July 13, 2000

About $2000 worth or 119 more shares on January 13, 2001

That’s right…

You would have kept buying the same stock again and again as the market (the Nasdaq in particular) crashed harder and deeper than it ever has before or again…

And you would have ended up with 265 shares of Amazon with a total cost basis of $37.70 per share.

That means instead of taking 9 years to break even on the stock, it would have only taken you until July 2003.

You would have seen a 100% gain in October 2007 and sold 133 of your shares for about $12,285 in cash — guaranteeing you a 22% return even if your remaining shares became worthless.

And then, if you continued to hold, adding no more money to your position…

Your $10,000 starting position—broken up into 5 tranches—would now be worth about $428,000, a 4,304% return on your investments.

Not only would you have made more money… You also would have been able to guarantee yourself a modicum of safety no matter what happened in the future.

This, my DIYwealth readers, is why I suggest the strategies I do…

It’s why I advocate a conservative “do as little as possible” approach to investing…

It’s why I advocate buying on the dip after a stock has declined in price (as long as the fundamentals of a company remain strong)…

And it’s why long-term strategies usually prevail over short-term ones.

All investing involves risk and uncertainty.

But if you know how to keep your emotions in check and go in with a smart strategy, you can minimize the risks and accelerate the growth of your wealth…

No matter what happens to the individual stocks in your portfolio or to the economy as a whole.