Why I Love Dividends (And Why You Should Too)

"... (The true investor) will do better if he forgets about the stock market and pays attention to his dividend returns and to the operating results of his companies." - Benjamin Graham

Everyone always goes on about this thing called “passive income”…

And I totally get it.

Everyone wants extra money without having to put in any… let’s say substantial additional work.

That’s the dream. That’s how most people think their retirement will go (even though they’re wrong).

As opposed to the income you get from your job, passive income just… falls from the sky, metaphorically speaking.

This can be royalty income, residuals, bond payments, rent checks, sales commissions…

Basically, it’s money that continually springs off of some past work or investment.

“Dividends” are the passive income you can get from stock investing.

And on a scale from one to amazing, dividends definitely rank higher than most things in the world…

Definitely higher than teething toddlers (not that I know anything about that at the moment).

Basically, companies like Coca-Cola or Apple or Hormel will pay you every quarter, four times a year (or more), just for buying a share of their stock.

You don’t have to do anything to collect dividend income.

And that makes dividend income perhaps the most passive kind of passive income out there…

Also potentially the most lucrative as well.

That is, if you know what you’re doing.

I want to dig in and talk about why dividend income is a critical ingredient for building wealth in the stock market…

An ingredient that stays on the spice rack a little too often in a kitchen recently dominated by meme stocks and hyper growth tech companies and other get rich quick nonsense.

I’ll share some of the reasons why dividends are crucial to your investing strategy…

And I’ll show you a quick example of how to quickly identify and buy dividend paying stocks. I’ll even give away my favorite tickers for prospective dividend investors.

But before all that, let’s get to the question nibbling at the back of your brain…

Why Would a Big Multinational Corporation Pay ME Money?

And that’s a really good question.

Say your ultimate goal in life is to sit around eating tubs of Cool Whip with your bare hands.

The answer to the question above, my disgusting friend, lies in the answer to THIS question:

Why do people start businesses?

To make money, obviously.

Well, if you start a business… say a super soaker designed specifically for squirting cool whip at high velocity into your orifice of choice…

After you cover your expenses to make and ship the product, you’ll have to figure out what you’re going to do with all the dozens of dollars you’ll make.

You can reinvest that money into growing the company (more factories, more research into the viscosity of Cool Whip, more marketing, etc.)...

Or you can pay yourself, giving yourself a salary and issuing yourself tax documents at the end of the year. But that means having to keep track of all that both on the payroll end as well as on the personal side… Which, while it’s tax deductible for the business, is a hassle.

OR you can simply distribute the cash your weird company brings in as a dividend to yourself.

Bingo bango, easy peasy, you’ve made money based on your Cool Whip obsession.

(When I was writing this, I wondered if I could stretch this inappropriate Cool Whip joke even further. So I looked up who makes it and sure enough, it’s Kraft-Heinz, a solid dividend payer. That means, for real, if you want to get back some of the money you’re spending on every tub of Cool Whip you pump into your body, you can just buy some Kraft-Heinz stock.)

I’m skipping a few steps, but that’s the gist.

The executives and major shareholders who own companies with large, steady cash flows that won’t really benefit from plowing money into growing the business will often decide to distribute some of that cash flow to themselves.

If YOU happen to be a shareholder in one of these businesses, you get some of that cash flow, too.

And if you’ve been hearing about all the people making money in the markets, wishing you could get involved, I have some news for you…

Dividends Are Key For Building Wealth Safely

Most people think stock gains come from buying low and selling high.

But in reality?

That’s only one piece of the puzzle.

Case in point: Everyone talks about how important it is to just invest your money in a passive index fund that tracks the S&P 500 (SPY would be the ticker if you want to do this without having to pay mutual fund fees).

But adjusted for inflation?

Between 1950 and 2021, if you just “bought low and sold high” without factoring in dividends, you would have only earned about 4.5% per year. $1 would have grown to $24 over 71 years.

Not great.

Put dividends in the picture? And you would have had 8% annualized returns. $1 would have grown to $253.

How is the difference this big?

Because if you look at the S&P 500’s returns and what exactly created those returns, the vast majority of those gains came from dividends and dividend growth.

Only a small fraction of the growth came from the actual change in value of the index.

And you can clearly see the reason why this is if you break down the market’s returns decade by decade.

In decades with low growth, no growth, or negative growth, dividends still provided hefty returns.

In the Guinness Atkinson Funds report, “Why Dividends Matter,” fund managers Dr. Ian Mortimer and Matthew Page provide even more reasons why dividends are crucial to an investor:

Market outperformance – Between 1972 and 2010, dividend growers returned 9.6% on average, compared to the S&P 500’s 7.3%. Non-payers underperformed, returning 1.7%.

Growth in bear markets – In periods of low economic growth, dividends have accounted for 75% of total returns.

Low volatility – During recessions, earnings per share of the S&P 500 can drop as much as 42%. But dividends per share only drop 8% on average. This provides investors with a “cushion” during recessions.

Inflation hedging – Dividend income usually grows in line with or faster than the rate of inflation.

And the reason dividend payers are such amazing contributors to growth is due to the magic of compounding.

Let me quickly explain how this phenomenon works for stocks…

Say you buy 1 share of the company Squibbly-Blork and it costs you $100.

Over the course of a year, the company pays you four $1.25 dividends per share for a total of $5 at the end of the year. This means the company has a (5/100=) 5% dividend yield.

Say you have selected, in your brokerage account, to reinvest your dividends (meaning that you have pushed a button and your brokerage automatically buys fractions of a share of Squibbly-Blork with the dividends you received).

At the start of the second year, you have more than 1 share of Squibbly-Blork.

Your reinvested dividends have given you 0.05 more shares. You own 1.05 shares now.

And guess what? Those partial shares pay dividends too.

Now here’s why dividends help you get higher returns in bear markets…

Imagine the market crashes. The stock went from $100 to $50 in value.

But the company’s business? Unaffected. Revenue, profits, all of it is the same. Only the stock price has changed.

So the board of directors, to attract more investors and therefore raise the stock price, decide to increase the $5 yearly dividend to $6.

Well. That doesn’t mean you get $6. You get $6 times the 1.05 shares you own now, which is $6.30.

That $6.30 reinvested buys you way more than 0.05 shares this year… Instead, it gets you ($6.30/$50=) 0.126 shares because the stock price was down. (I talked about this concept, called “CBA,” more here.)

Then the market recovers and Squibbly-Blork jumps back up to $100 per share.

But even though you only spent $100, you have 1.176 shares of the company.

Meaning you have GAINED a 17.6% total return on the stock… even though its price has changed by 0% from when you bought it.

And it gets even crazier…

Because say the company decides to keep that $6 dividend the same in year 3. Meaning, the dividend yield is (6/100=) 6%.

Well, that’s the dividend yield for someone who just bought the company.

You spent $100 initially…

But now you have 1.176 shares. So you’re now earning (1.176*6=) $7.05.

That’s right… your effective yield on your original investment is now 7%. That’s 16.6% higher than the yield Joe Schmoe on the street would get if they finally decided to buy now.

Are you starting to see how dividends can put your stock returns into hyperdrive?

That’s only the beginning of the benefits too…

There are whole strategies based around pooling dividends to purchase the cheapest asset in your portfolio (which can accelerate your compounding)...

You can collect dividends from funds and dividend paying companies and use that money to buy hyper-growth tech stocks effectively for free…

You can collect dividends for a while, build up a base of shares, and then sell your original investment amount to buy something else, which allows you to own not one but TWO compounding assets…

You can even fund your entire retirement with just one stock, so long as you own enough and it pays a safe enough dividend.

So say you want to get some of that tasty, tasty dividend money but you don’t even know where to begin.

Let me show you…

How to Find Dividend Paying Companies

If you want an easy list of companies paying dividends and growing them consistently, just search for Dividend Kings, Dividend Aristocrats, or Dividend Achievers.

Dividend Kings are members of the S&P 500 that have increased their dividends for at least 50 consecutive years (there are only 40 companies that have done this).

Dividend Aristocrats are S&P 500 companies that have upped their dividends for 25 years in a row or more (there are 66 companies that have done this).

And Dividend Achievers have 10-plus years of dividend growth (there are 347 companies that have done this).

If you see a stock on one of these lists you’re interested in buying…

You can look up the company or ticker symbol on Google or Yahoo! Finance.

Look for this number called the Dividend Yield:

That number tells you that 3M paid, over the last 12 months, $5.93 in dividends per share, or about $3.97 for every $100 you had invested.

(For most ETFs and funds, this number will not be visible. You have to look up the company managing the fund and then search for the distributions or yield for the fund.)

Now, I’m NOT suggesting you just go out and buy the stock with the biggest dividend yield…

Because some companies will actually pay out more than they can afford to based on their profits.

This is called the “Payout Ratio,” and a company that pays out too much of its profits as dividends is at risk of cutting its dividend (or worse).

You can find this number for free using a site like GuruFocus. For instance, you can see 3M’s payout ratio here.

Once you’ve decided on a dividend paying stock you like, it doesn’t take much to begin investing in it.

You can start with as little as $1.

I’m totally serious.

You can download an app like Robinhood or any other brokerage that offers fractional share buying…

Buy $1 worth of a dividend-paying company like 3M (MMM), as I just did...

And then 3M will pay you every quarter, for as long as it pays dividends.

You can be sure this is a fairly safe bet, too, because 3M has paid dividends to its shareholders without interruption for more than 100 years and increased the annual dividend for 64 consecutive years.

Congrats, you just learned how to become a dividend investor.

The most relaxed, delightful kind of investor you can be.

But if you’ve been reading what I send you going, “Compounding? Passive income? That’s for rich folk. Not for me.”

Well, I just showed you how getting wealthier by investing in compounding assets is something you can literally do today for $1.

Heck, if you actually cared about getting richer, you’d get off your butt and do this right now.

It won’t take you any more than 30 minutes.

I’ll even make it easier for you…

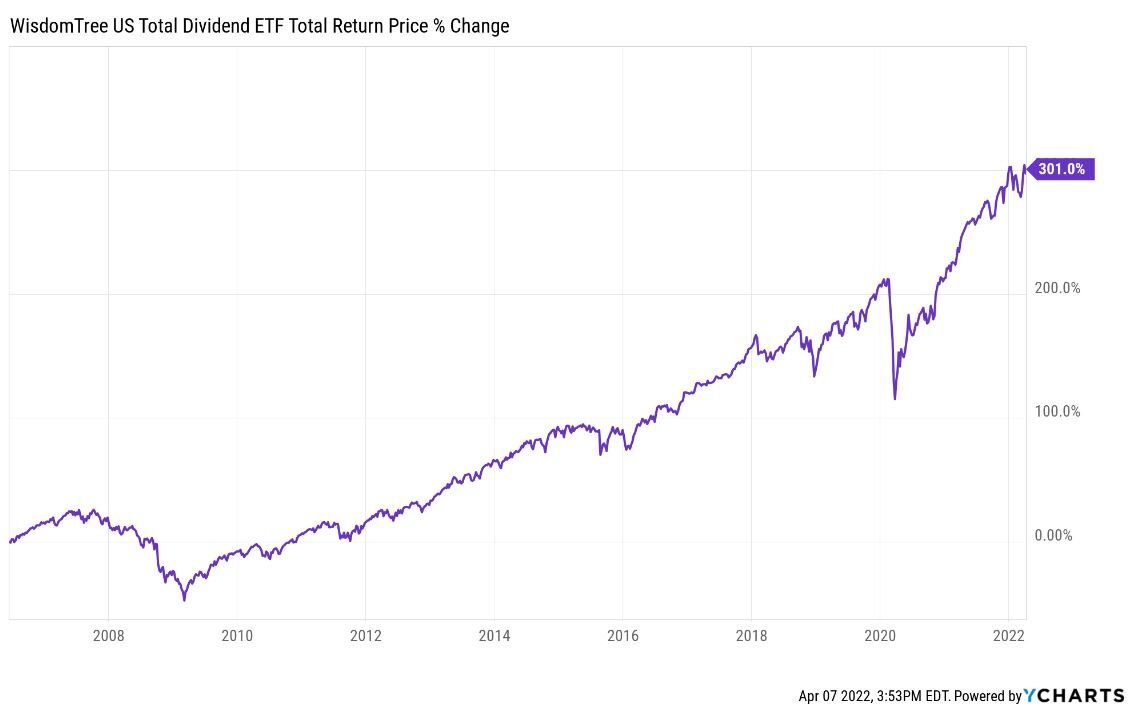

You can buy $1 worth of the ticker $DTD.

Just look at this chart…

This is the WisdomTree Total U.S. Dividend Fund. It’s a fund that holds every dividend stock listed in the U.S.

Every. Single. One.

It pays investors monthly. You get paid a dividend every single month.

That’s why I call this ETF a “super-compounder.”

I’ve been buying $10 worth of $DTD and $TDIV every day since I began the Finance Daddy $10 Daily Challenge…

And even though the dividend income was small at first…

Every month, I get a bigger and bigger dividend check slipped into my pocket.

Now, look…

I could go into way more depth when it comes to this…

But investing? You can build SERIOUS wealth doing nothing more complicated than what I just described to you here.

You also don’t need to work hard for your money to grow on its own.

In fact, my philosophy when it comes to investing is: Try to do as little as possible.

This way I never get tempted to trade and lose money, and I never get tempted to sell and miss out on gains. I can just relax and shovel Cool Whip into my mouth.

Obviously, if you have a lofty goal or want to accelerate your gains, that’s possible too.

But investing and wealth should FREE you to do the things you want to do in life, not bind you to a trading terminal.

So I’ll leave it here, for now, and give you one of my favorite quotes from one of the research reports I mentioned earlier.

“Profits are a matter of opinion, dividends are a matter of fact.”

That is, there can be no creative accounting where dividend payments are concerned.

A dollar in your pocket is just that: your cash.

And that cash gives you more wealth and freedom. End of story.